Forex broker XM is a well-known name in the forex industry. In this review, we will dive into the key aspects of XM Malaysia in 2023, including company details, regulation and licensing, pros and cons, trading instruments, customer support, trading accounts, deposits and withdrawals, the process of opening a trading account, and why XM stands out as a preferred choice for traders.

Forex broker XM was established in 2009 and is the trading name of Trading Point Group, a conglomerate of companies. The broker has its headquarters in Cyprus, but it operates globally, serving traders from over 190 countries.

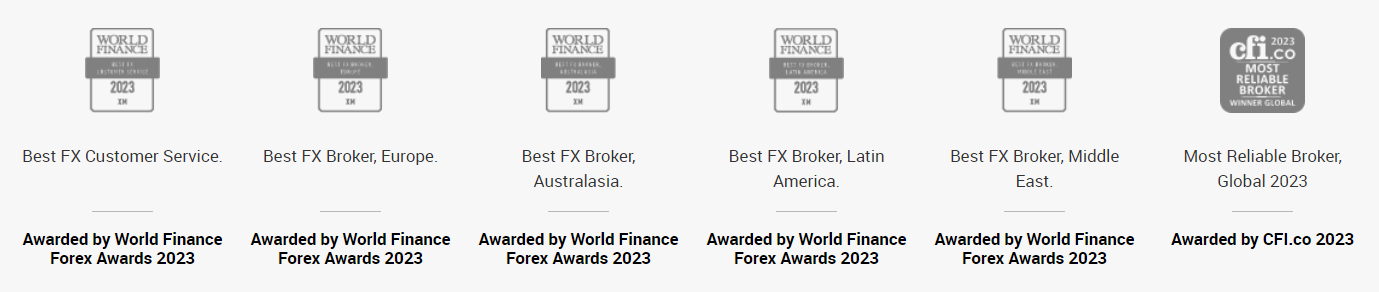

XM received several awards including Best FX Customer Service, Most Trusted Asian Forex Broker, Best FX Broker Middle East, and more.

Company Details

| Website | xmfxbroker.com |

| Country | Cyprus |

| Support Language | Malay, English, Chinese, and More. |

| Office Locations | Cyprus, Australia, Belize |

| Founded | 2009 |

| Regulated By | CySEC and FSC |

| Min. Deposit | 5 USD |

| Bonus | Yes |

| Max. Leverage | 1000:1 |

| Platform | MT4 & MT5 |

Regulation and Licensing

XM is regulated by several reputable financial authorities. These regulatory bodies ensure that XM complies with strict financial and operational standards, providing an added layer of security for traders. This regulatory oversight helps ensure that the broker operates transparently and in accordance with established industry norms.

XM Global Limited, authorized and regulated by the Financial Services Commission (FSC) (license number 000261/397), and Trading Point of Financial Instruments Limited, authorized and regulated by Cyprus Securities and Exchange Commission (CySEC) (license number 120/10), are members of Trading Point Group.

XM Pros and Cons

Pros:

- Regulation and safety.

- Variety of trading instruments.

- Multiple account types.

- Low minimum deposit.

- Good customer support.

Cons:

- Limited product portfolio.

Trading Instrument

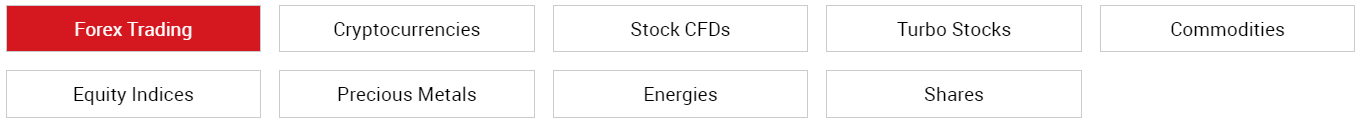

XM provides a wide range of trading instruments. These instruments include major, minor, and exotic currency pairs. Additionally, XM offers CFDs (Contracts for Difference) on commodities, stock indices, individual stocks, precious metals, and cryptocurrencies.

Customer Support

For traders in Malaysia, you can reach XM customer support via phone by dialing these numbers: +501 223-6696 and +501 227-9421. You can also contact them via email at support@xmglobal.com. For a faster response, I recommend contacting them via Live Chat, which is available on their official website (laman web).

Their customer support is available 24 hours a day, 7 days a week. It is offered in various languages, including Malay, English, Chinese, and more.

Trading Accounts

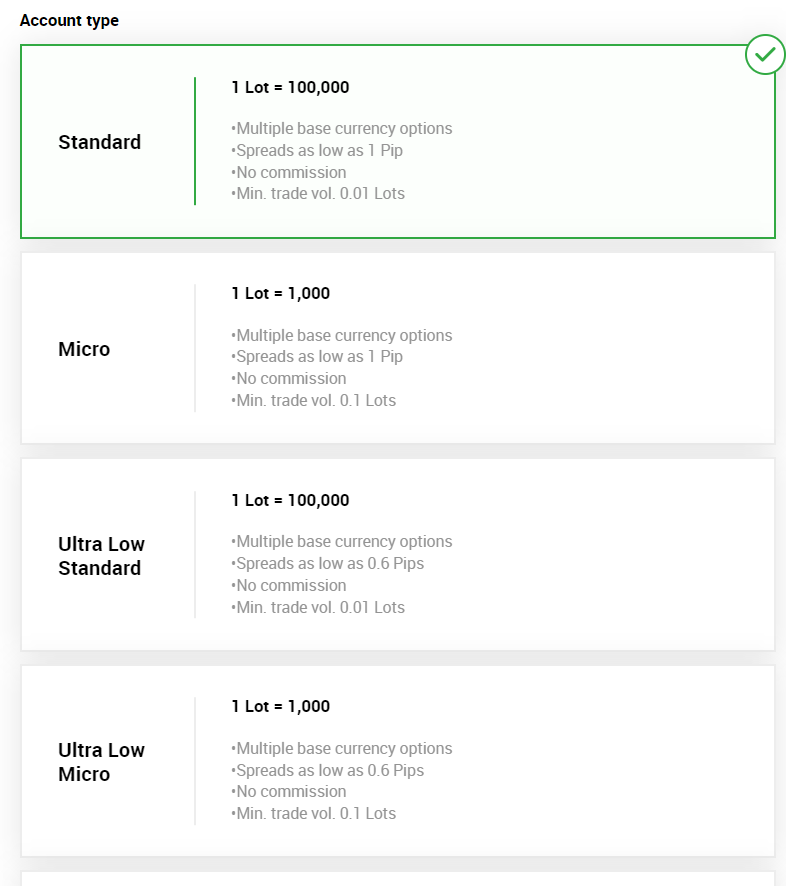

XM offers various trading account types, including Micro, Standard, Ultra Low, and Shares accounts. These accounts come with varying spreads, leverage options, and minimum deposit requirements.

Micro Account

| Based Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR |

| Contract Size | 1 Lot = 1,000 |

| Leverage Up to | 1:1000 |

| Negative balance protection | Yes |

| Spread on all majors | As low as 1 pip |

| Commission | No |

| Maximum open/pending orders per client | 300 positions |

| Minimum trade volume | 0.1 Lots (MT4) 0.1 Lots (MT5) |

| Lot restriction per ticket | 100 lOTS |

| Hedging allowed | Yes |

| Swaps | Yes |

| Islamic Account | Optional |

| Minimum Deposit | 5 USD |

Standard Account

| Based Currency Options | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR |

| Contract Size | 1 Lot = 100,000 |

| Leverage Up to | 1:1000 |

| Negative balance protection | Yes |

| Spread on all majors | As low as 1 pip |

| Commission | No |

| Maximum open/pending orders per client | 300 positions |

| Minimum trade volume | 0.01 Lots |

| Lot restriction per ticket | 50 Lots |

| Hedging allowed | Yes |

| Swaps | Yes |

| Islamic Account | Optional |

| Minimum Deposit | 5 USD |

XM Ultra Low Account

| Based Currency Options | EUR, USD, GBP, AUD, ZAR, SGD |

| Contract Size | Standard Ultra: 1 Lot = 100,000 Micro Ultra: 1 Lot = 1,000 |

| Leverage Up to | 1:1000 |

| Negative balance protection | Yes |

| Spread on all majors | As Low as 0.6 Pips |

| Commission | No |

| Maximum open/pending orders per client | 300 positions |

| Minimum trade volume | Standard Ultra: 0.01 Lots Micro Ultra: 0.1 Lots |

| Lot restriction per ticket | Standard Ultra: 50 Lots Micro Ultra: 100 Lots |

| Hedging allowed | Yes |

| Swaps | No |

| Islamic Account | Optional |

| Minimum Deposit | 5 USD |

Shares Account

| Based Currency Options | USD |

| Contract Size | 1 Share |

| Leverage Up to | No leverage |

| Negative balance protection | Yes |

| Spread on all majors | As per the underlying exchange |

| Commission | No |

| Maximum open/pending orders per client | 50 Positions |

| Minimum trade volume | 1 Lot |

| Lot restriction per ticket | Depending on each share |

| Hedging allowed | No |

| Swaps | No |

| Islamic Account | Yes |

| Minimum Deposit | 10,000$ |

Deposits and Withdrawals

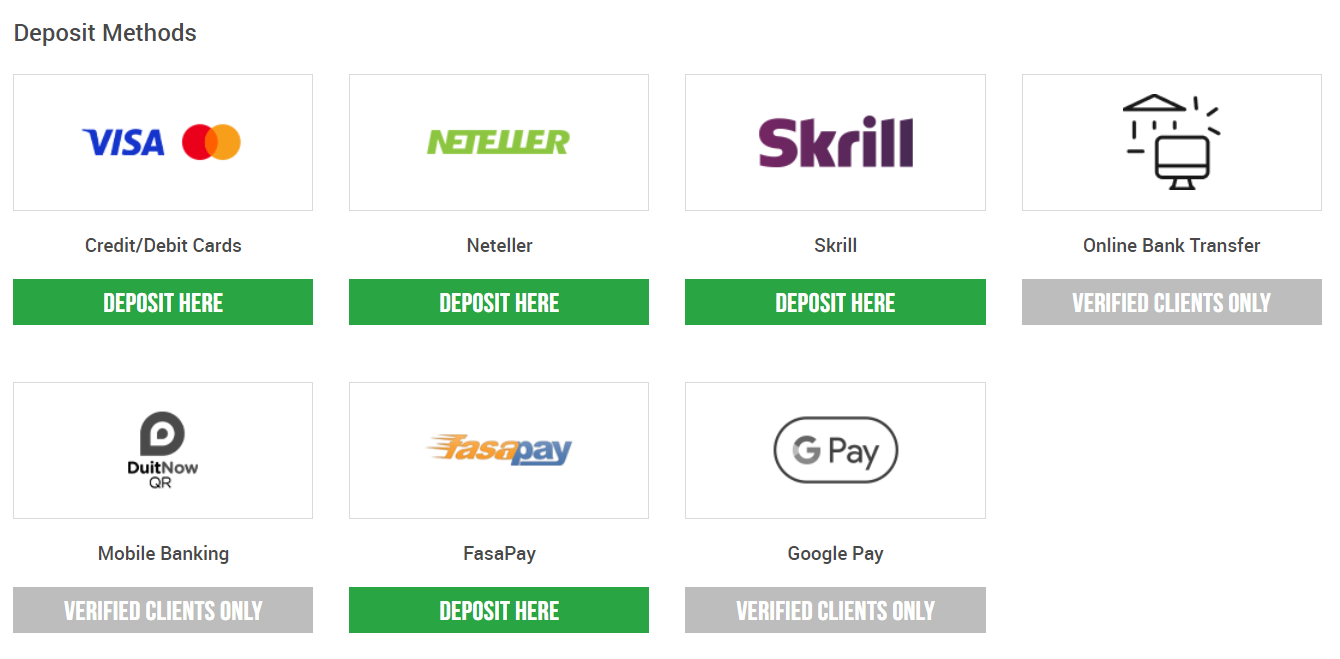

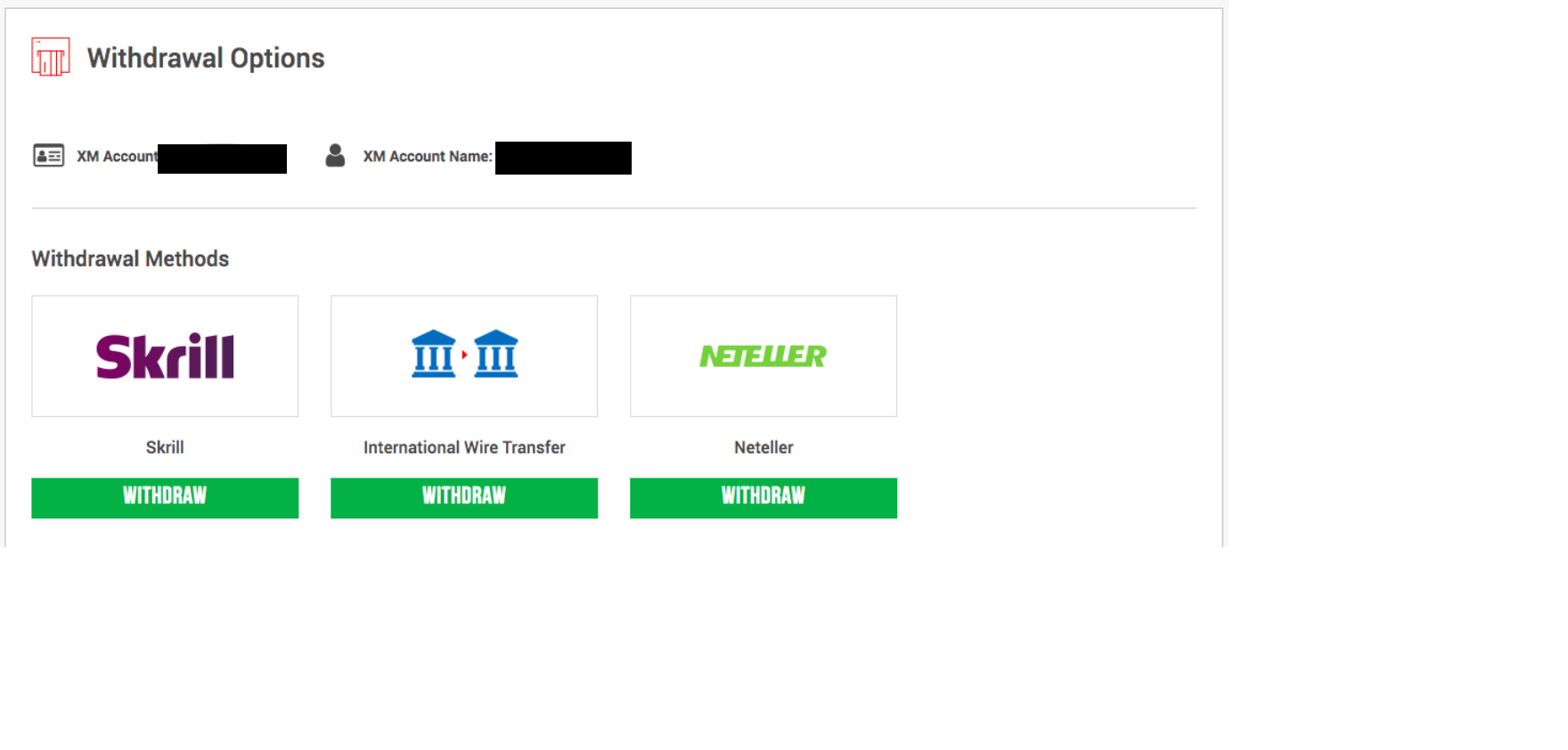

XM forex broker offers a variety of convenient methods for deposits and withdrawals, including online bank transfer, credit/debit cards, e-wallets, and more. For Malaysian traders, the easiest way to deposit and withdraw your funds is via online bank transfer.

Please note that the XM broker covers all transfer fees (deposits and withdrawals) on both sides. Except for the currency conversion fee that your bank may charge.

The withdrawal process depends upon the method:

- If it’s e-wallet, it’s instant.

- If it’s an online bank, 3 working days

- If it’s a Card, it’s 2-5 working days.

How to Open XM’s Trading Account

To open a trading account with XM broker you need to prepare the items below:

- Laptop, smartphone or tablet.

- Internet connections.

- Fund to deposit your trading account. The deposit minimum is 5 USD (RM 23.42).

please follow the steps below to open an XM trading account.

Step 1

Click the “Open Account” button below to open a trading account with XM forex broker.

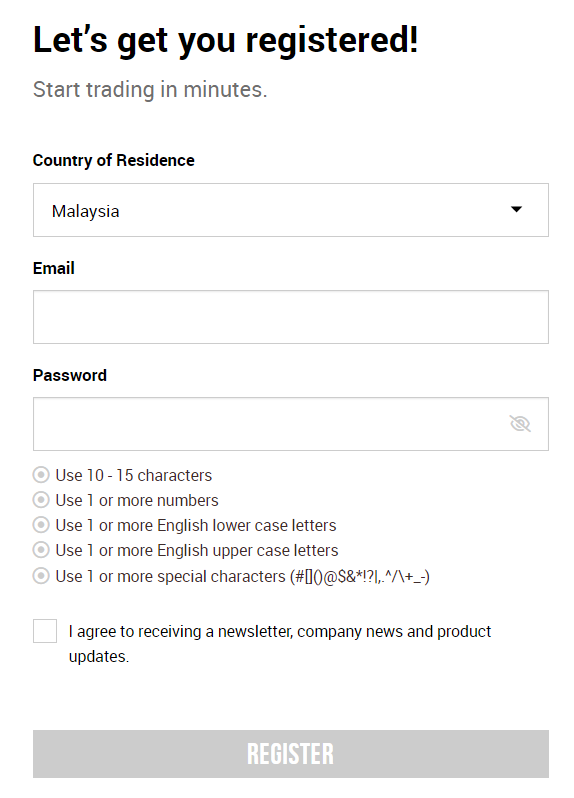

Step 2

Fill in your email and password.

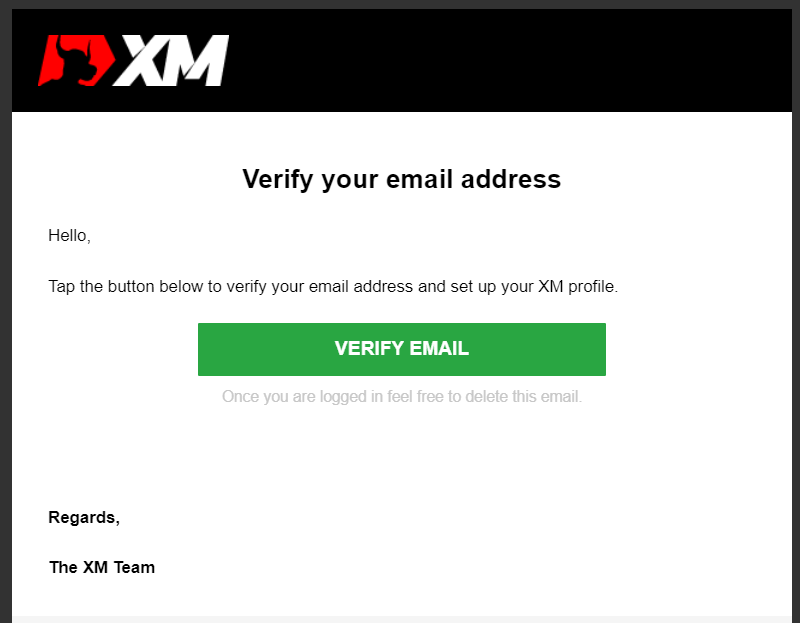

Step 3

Check your email and click the “Verify Email” button to verify your email address.

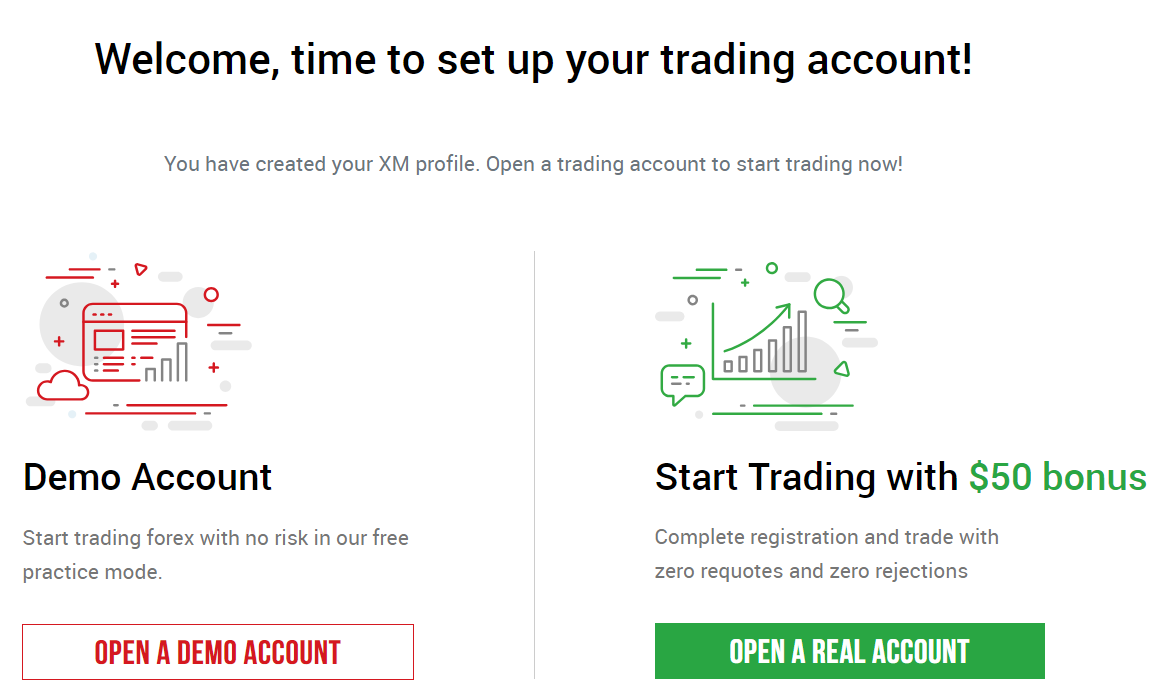

Step 4

Click “Open A Real Account” to open a real account with XM Malaysia.

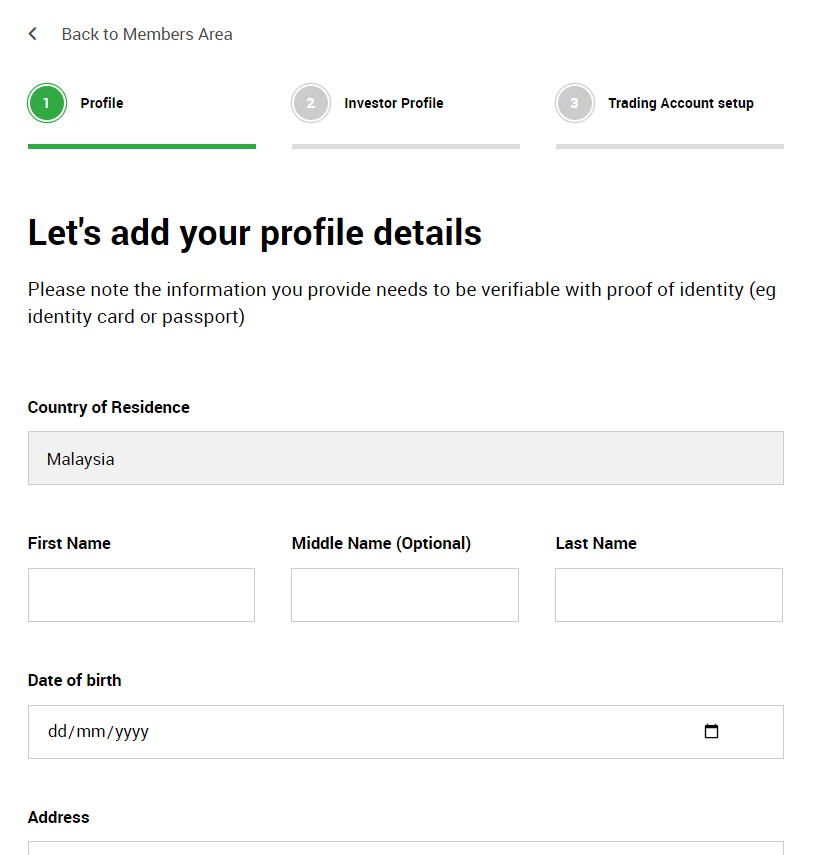

Step 5

Now, you need to complete your account profile by filling in the form below with relevant information.

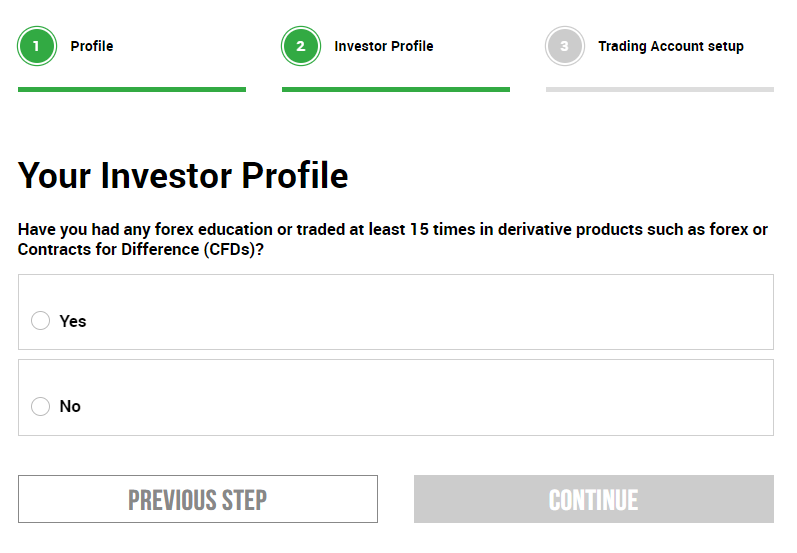

Step 6

Now, you need to fill in your investment profile. If you have experience in forex trading, click “Yes”; if not, click “No.”

Step 7

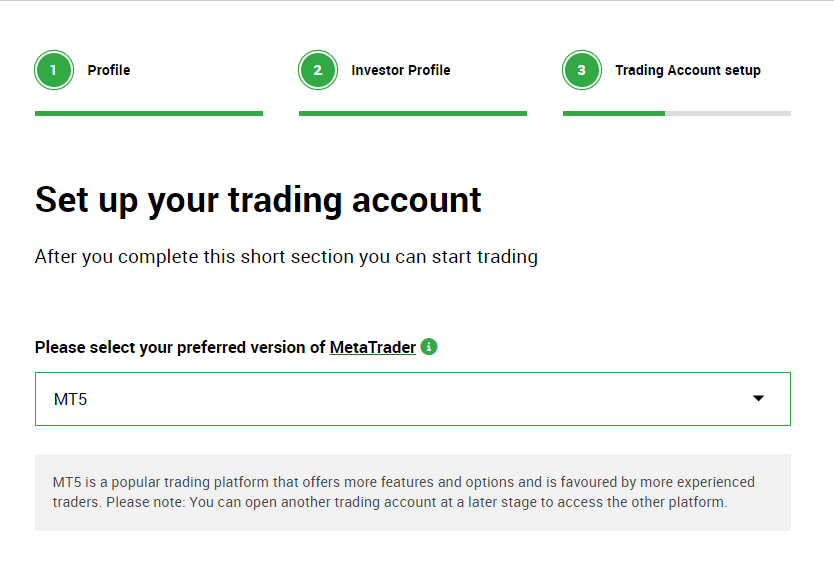

Next, you need to set up your XM Forex trading account. First, please choose your preferred trading platform.

Secondly, choose your account trading type.

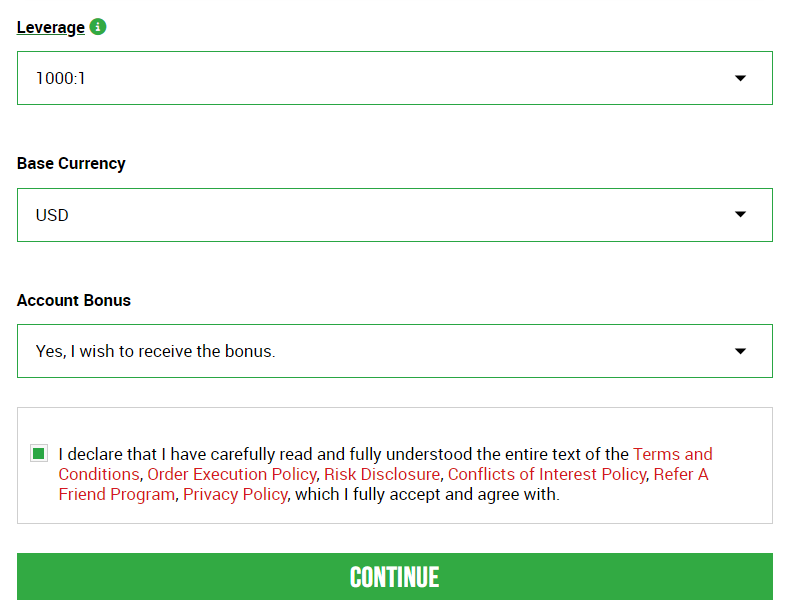

Lastly, select your leverage and base currency. After that, click the “Continue” button.

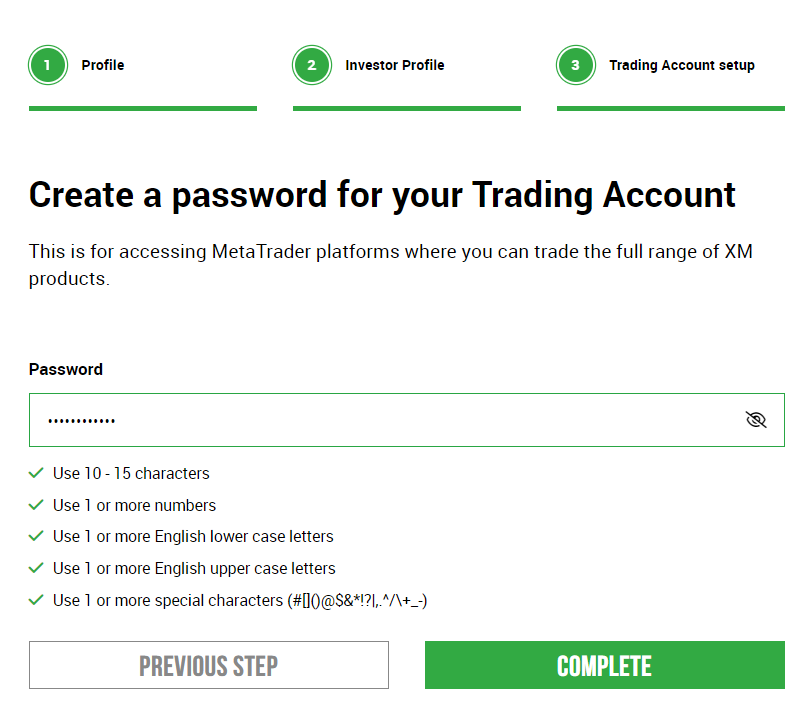

Step 8

Set up your trading account password once again. (you can change your password anytime you want).

Step 9

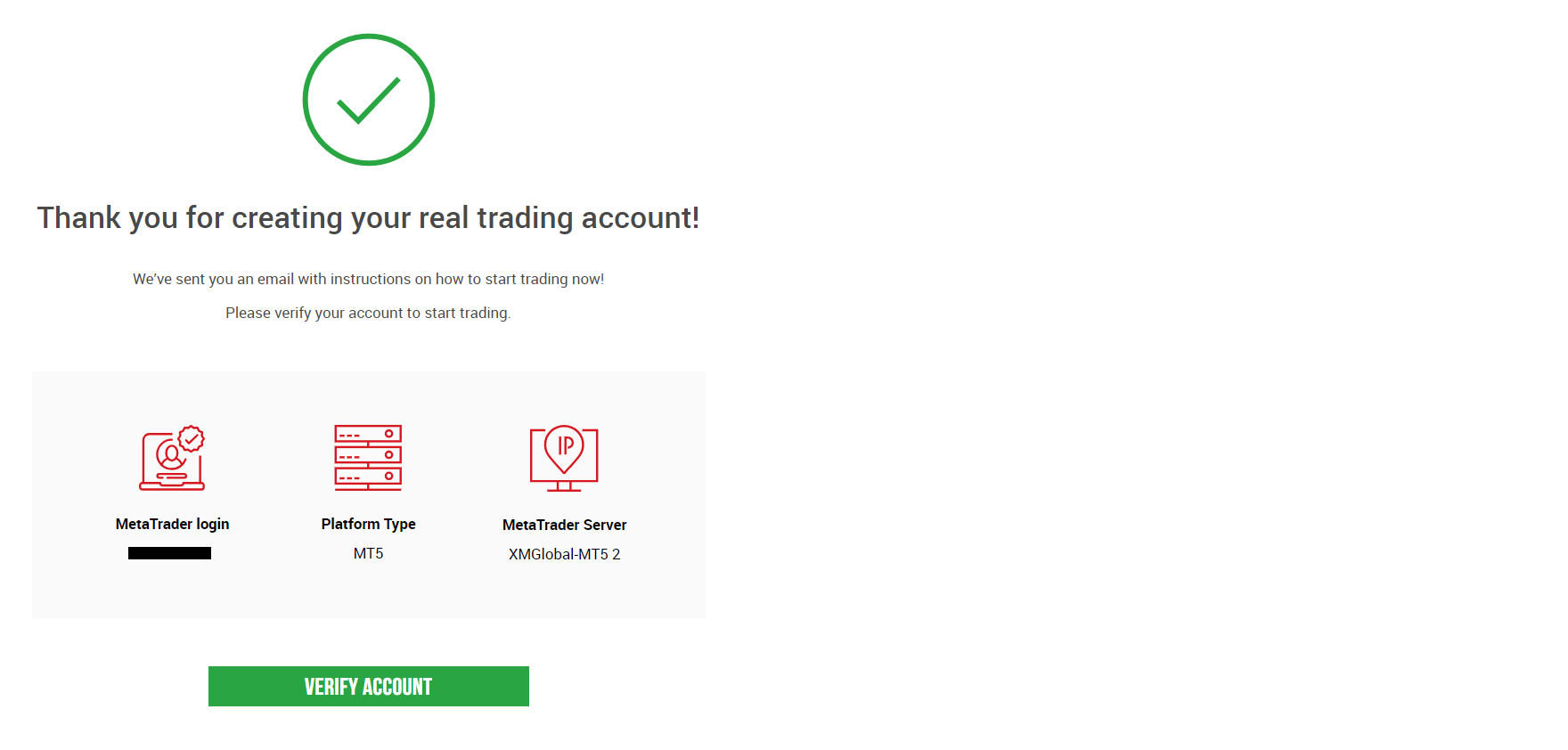

Now, you have completed the registration process.

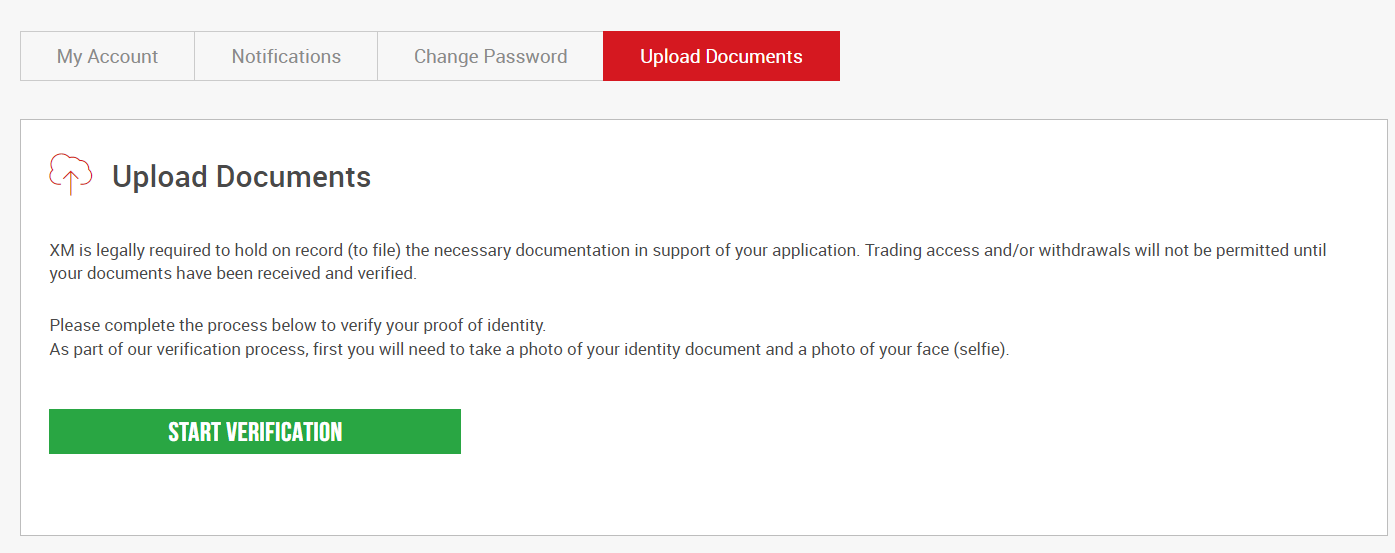

Step 10

The last step is to upload your ID to verify your trading account. After your trading account is verified, you can deposit funds into your trading account and start trading forex. Click here to learn more about how to deposit funds into your trading account.

Why You Should Use XM?

- Broker XM is an award-winning forex broker in Malaysia that provides a secure and trusted trading platform.

- Deposit minimum as low as 5 USD.

- The fact that XM claims to have over 10 million clients could suggest that many traders trust the platform. A large client base can imply stability and reliability.

- The availability of secure payment methods could make it convenient for traders to deposit and withdraw funds. Diverse payment options can accommodate various preferences and regions.

- Having access to more than 10 full-featured trading platforms is beneficial as it allows traders to choose a platform that suits their trading style and preferences.

- XM’s support for over 30 languages and availability 24/7 means that they aim to provide a user-friendly experience for traders from various linguistic backgrounds.

Conclusion

In conclusion, XM Malaysia stands as a reputable and user-friendly choice for forex traders in 2023. Established in 2009, it has garnered recognition through numerous awards. So, whether you’re an experienced trader or just starting, XM Malaysia is worth considering for your forex trading needs.